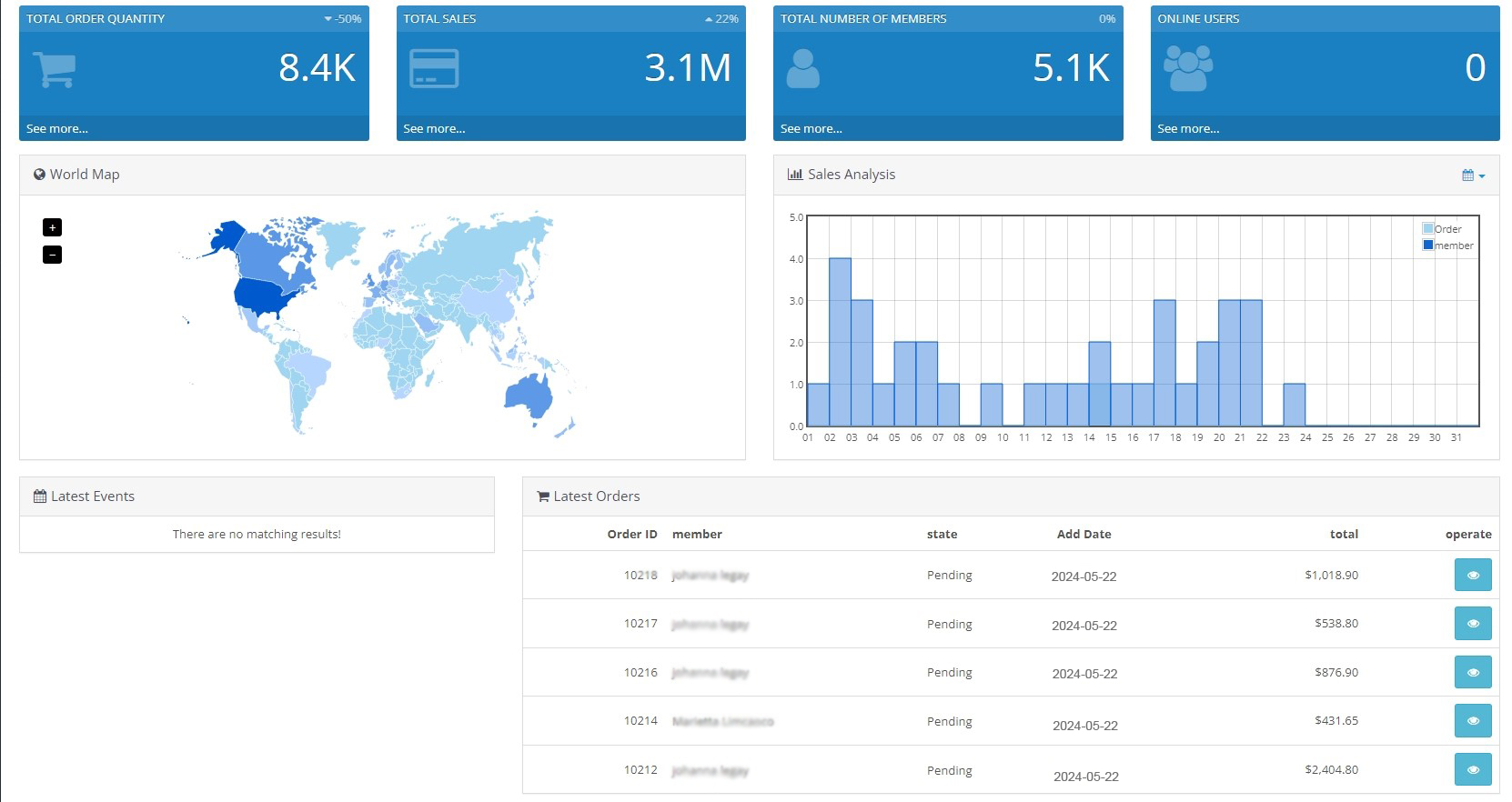

As our independent store incubation program grows, many sellers are receiving increasing volumes of orders. Along with this growth comes the critical need for secure and stable payment solutions—and that’s where PayPal plays a vital role.

In the world of e-commerce, especially when offering designer-inspired products or premium lookalike collections, how can we safely and compliantly use PayPal for order payments?

In truth, whether your product is branded-inspired or just a general item, the key to PayPal account longevity lies in standardized usage—not the product type. For smaller sellers in particular, PayPal’s main concern is not the item, but how you use the account.

Let’s dive into how you can safely register, maintain, and grow your PayPal account to ensure smooth and uninterrupted payment processing.

① Account Registration: Build on a Clean Foundation

There are no secret tricks here—just follow these best practices.

1. Use Authentic, Clean Materials

Use real and original information: personal ID, passport, business license, local address, and phone number. Avoid downloading or buying info online—it won’t pass verification later (e.g. facial recognition or KYC checks).

Ensure all information is unique and unused. Duplicate use of ID, bank cards, or phone numbers may trigger PayPal’s association detection and cause account closure.

2. Use a Real, Local Network

Do not use VPNs during registration. Use a genuine local IP from your physical location. VPN use may make PayPal believe the registration is fraudulent, triggering additional reviews or instant bans.

3. Avoid Digital “Associations”

PayPal is strict about device and data environment cleanliness. Register using a clean device and IP. Don’t reuse any device, browser, or IP associated with a previously banned account.

If resources are limited, use anti-detection browser tech or VPS-based isolation environments to avoid overlap.

② Account Maintenance: Raise Your Account Like a Digital Asset

Once you’ve registered your account, it’s time to nurture it properly:

1. Bind a Dual-Currency Bank Card

Connect a clean, unused Visa or Mastercard. This builds PayPal’s trust in your account. Cards from banks like China Merchants Bank or Bank of Communications are commonly used.

2. Keep IPs Stable and Consistent

No VPNs! If managing multiple accounts, use isolated environments like VPS or anti-detection browsers to prevent cross-account association.

3. Simulate Natural User Behavior

Login manually, browse menus, log out, clear browser cache—make it look like a real person is using the account. This increases trust.

4. Conduct Low-Volume Transactions

Start with small test transactions: $0.50–$5 per transaction, once or twice per day. You can ask overseas friends or use safe services to send small payments.

The goal: create a transaction history to increase account authority.

5. Prepare for KYC Reviews

PayPal will eventually require KYC verification, especially for newer accounts. Be ready to provide:

Business info (what you sell)

Order sources (where products are sourced)

Logistics info (how you ship)

Tracking numbers

This is a standard part of the process, not a punishment.

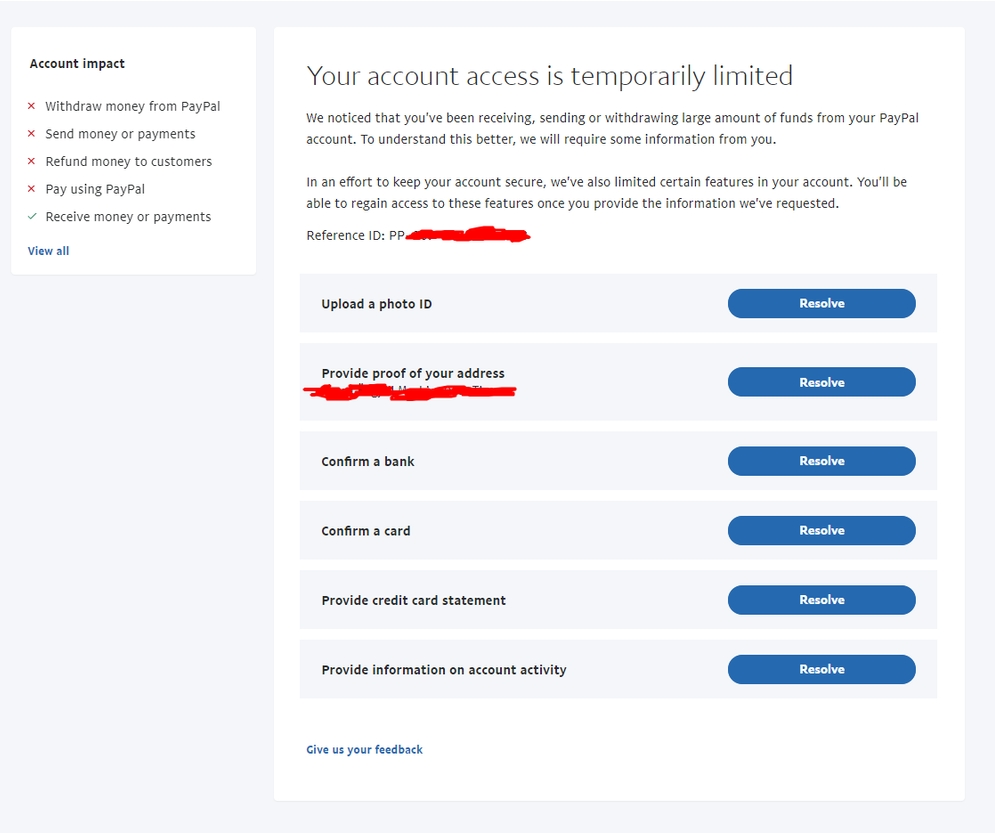

③ Account Suspension: Common Pitfalls and How to Avoid Them

To avoid losing your account, stay aware of these red flags:

1. Dirty Environment

Don’t use a previously flagged device or network. Register and operate in a fresh, clean digital environment.

2. Digital Associations

Don’t reuse registration materials. Each ID, bank card, and phone number should be one-time use only. Reuse = ban risk.

3. Inability to Pass Verification

Many people buy pre-made PayPal accounts, but most can’t pass KYC. That’s why it’s best to build your own account from scratch. It’s safer and more sustainable.

Think of your PayPal account like a child—you’ll always take better care of the one you raised yourself.

4. Abnormal Transaction Patterns

New accounts should never receive large payments immediately. Start with small amounts.

If you expect high volume, rotate payments across multiple accounts to distribute risk.

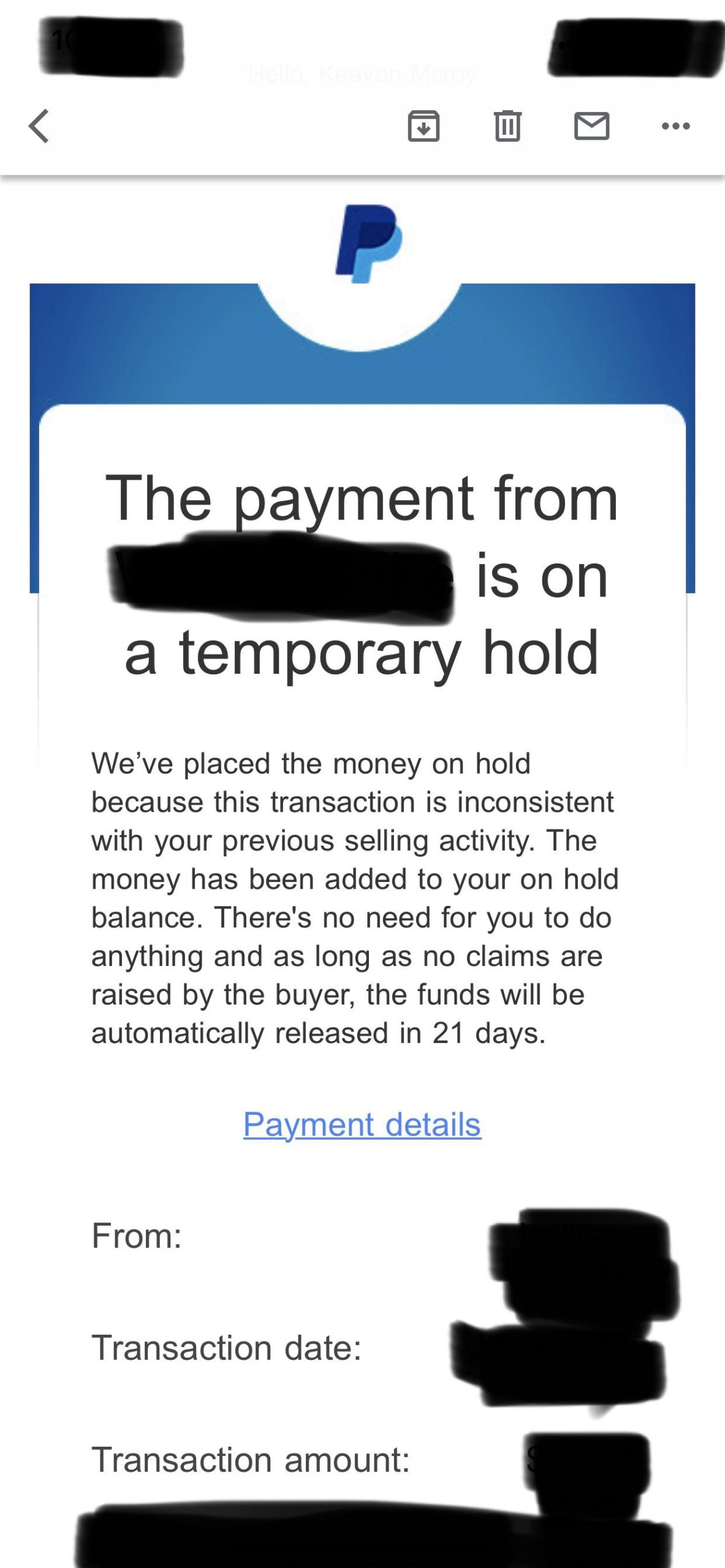

5. Withdrawal Behavior

PayPal holds new account funds for up to 21 days to ensure order fulfillment.

To unfreeze funds faster:

Upload shipping/tracking info ASAP

Have the buyer confirm delivery

Don’t withdraw 100% of the balance—keep 10–20% in the account to reduce risk flags.

6. Customer Disputes

No matter what you’re selling, PayPal prioritizes buyer satisfaction. Too many disputes will freeze or kill your account—even if you sell general goods.

So it’s critical to:

Maintain good after-sales service

Ensure product quality

Keep complaint rates low

Happy buyers = happy PayPal.